Supernova talks to legislators on their turf

The politicians who vote on restructuring taxes are not experts on every facet of the industries in their jurisdiction. As cannabis operators, advocates and consumers, it is imperative we educate them on how things are truly going on the ground. Bloated taxes and strenuous regulations are threatening the viability of the cannabis economy. Executive Director, Amber Senter, is driving that message home to policy makers.

SACRAMENTO, CA | CALIFORNIA SENATE SUBCOMMITTEE #4 INFORMATIONAL HEARINGS

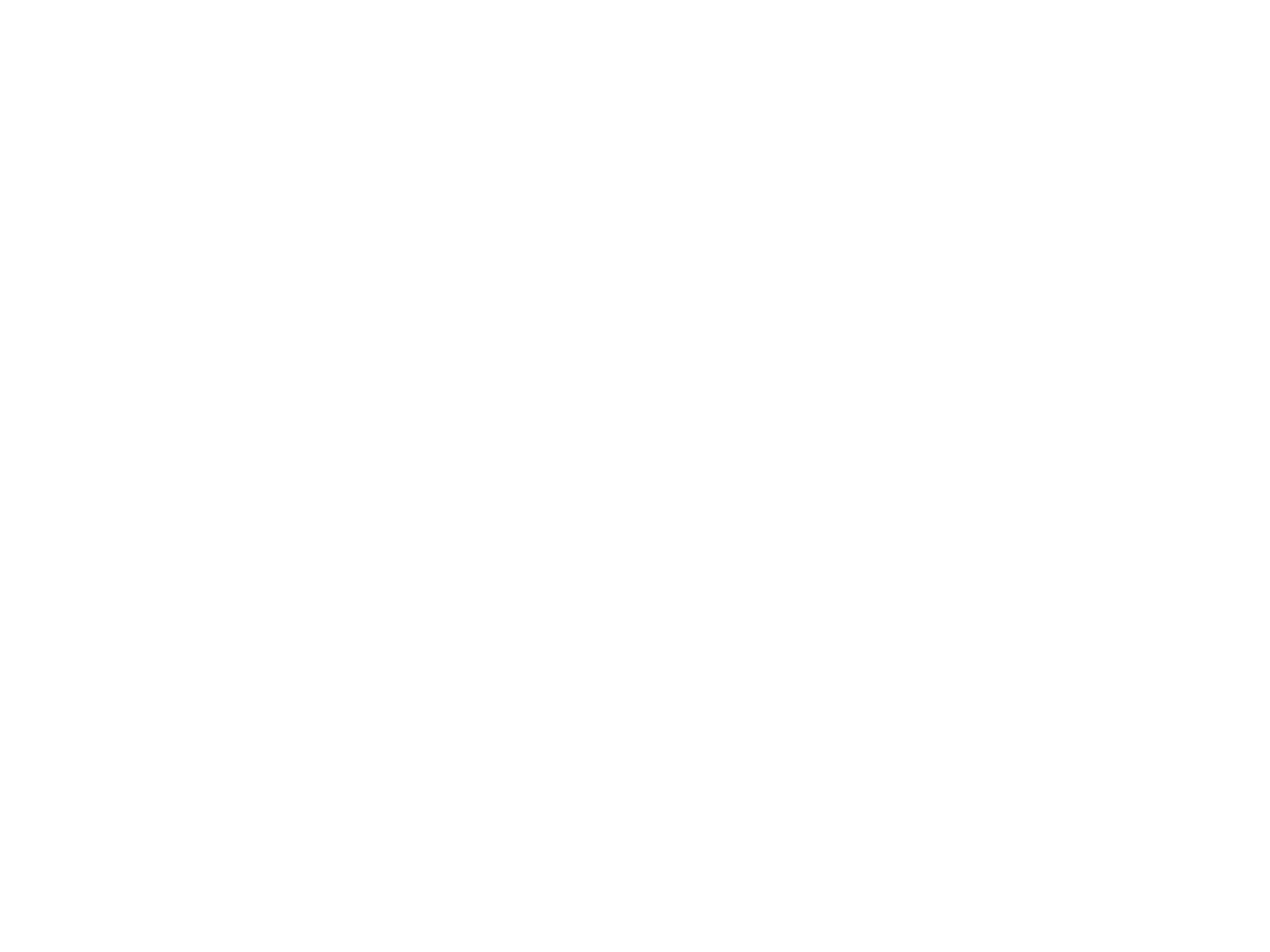

Supernova Women escalated the demand for tax reform to the California State Senate Subcommittee #4 on February 23, participating in an Informational Hearing. Speeches from several leaders of the California cannabis industry served as a cold splash to the face for Senate Subcommittee members- some just as confused as we are about how the cannabis tax situation ended up so convoluted. There was even a point during the explanation of the complex tax flow chart (Figure 4) where a Senator jokingly commented, “I give up.”

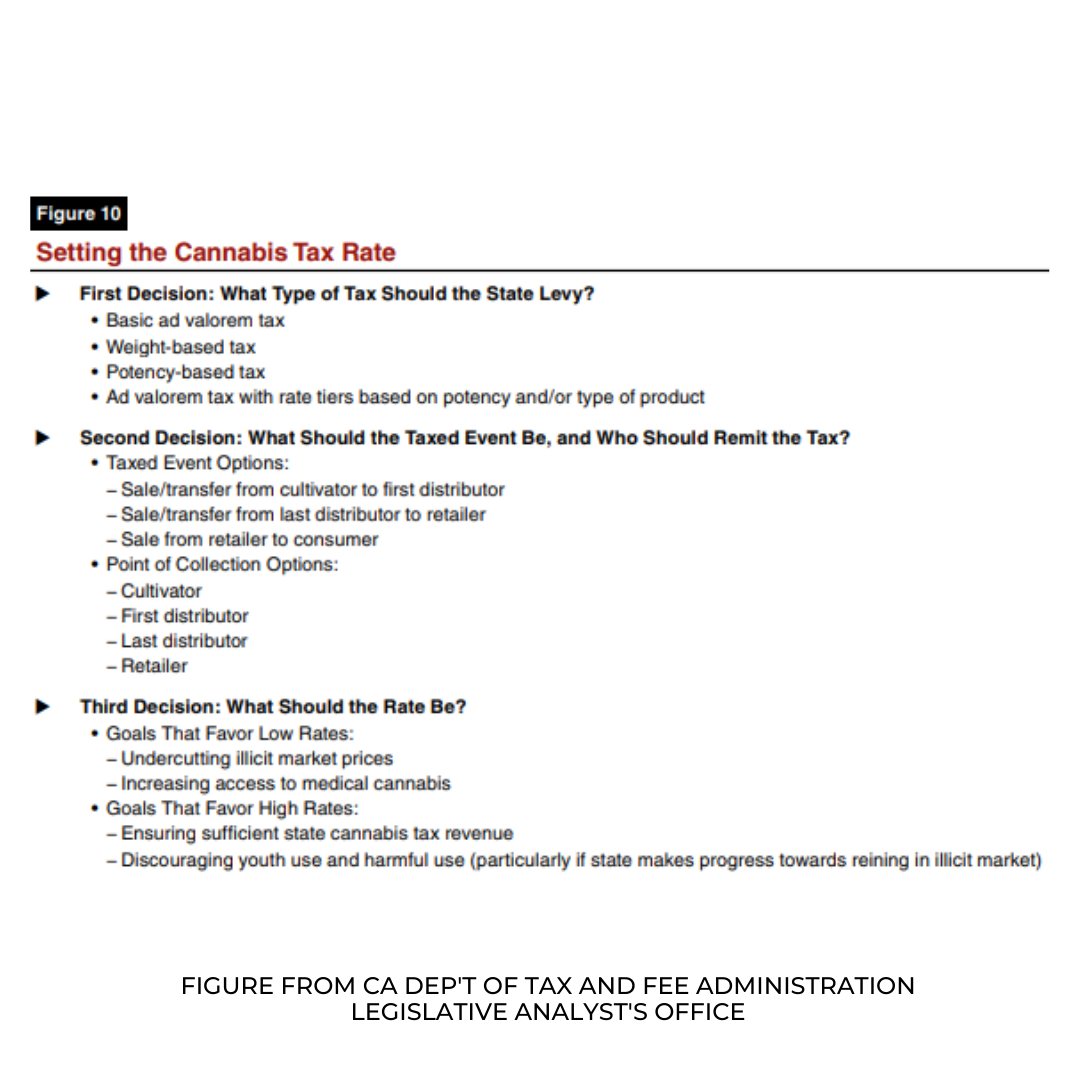

Our Executive Director, Amber E. Senter, spoke at the hearing; giving background to her experience as an operator in Oakland and reiterating the importance of tax reform for craft cannabis to survive. We are looking to eliminate the cultivation tax; the very same recommendation passed down by the state’s Legislative Analyst Office as far back as 3 years ago.

After talks around the table with our allies and coalition members, we have decided to amend our second demand regarding the state excise tax on social equity retailers. In the spirit of compromise, we are seeking the excise tax be suspended for equity operators for a minimum of 6 years.

Next steps: A bill must be authored by CA legislators and get a ⅔ vote from the legislature for it to pass in July. Attaining a two-thirds vote is a huge undertaking- so we need the cannabis community to do their part. Reach out and wear down your local California State Senators and California House of Representative members. Demand sustainable taxes so that independent and social equity operators have a chance at survival. End the cultivation tax and suspend the excise tax for equity retailers for a minimum of 6 years.

PHILADELPHIA, PA | HOUSE DEMOCRATS ISSUES CONFERENCE 2022

The charge for reform pressed on in Philadelphia, where our Executive Director, Amber Senter, was invited by Rep. Barbara Lee to speak as a panel expert at the House Democratic Issues Conference. The panel was about setting the federal cannabis economy on an equitable course. Black and Brown people who have endured the long-lasting and compounding consequences of war on drugs policies should have priority access to licensure.

The panel went on to discuss that beyond social equity programming, independent black business should be afforded support and protections as well. Senter stated, “I’m an operator and owner of a cannabis business in Oakland. And I wanted the lawmakers to understand the difference between social equity and black business, because a lot of the lawmakers believe that they’re all the same—that if you’re a black person, you qualify for social equity, and that’s simply not true.”

Props to fellow panel members Congressman Ed Perlmutter, Rep. Ilhan Omar, Rep. Ayanna Pressley, Maritza Perez from Drug Policy Alliance, Amber Littlejohn from MCBA, Congresswoman Barbara Lee and John Hudak from Brookings Institute.